Pursuant to SEBI notifications, Crisil Limited (Crisil) has transferred its Ratings business to its wholly owned subsidiary, Crisil Ratings Limited (Crisil Ratings), with effect from December 31, 2020. Any reference to Crisil in the documents published by the Ratings division of Crisil, such as Rating Rationales, Credit Rating Reports, Press Releases, Criteria, Methodology, FAQs, Policies and Disclosures, shall henceforth refer to Crisil Ratings.

Regulatory Disclosures

In this section you will find disclosures made under various Regulations/Circulars/Guidelines issued by SEBI, RBI and IOSCO. Please click on the heading given below for relevant information.

SEBI

Disclosures as per SEBI circular dated May 16, 2024

Conflict of Interest

Policy for dealing with Conflict of Interest in investment / trading by Crisil Ratings Limited, Access Persons and other employee

Entities that have sought moratorium

List of Crisil Ratings -rated companies that have sought moratorium on their debt facilities

Common Director disclosure

Common Director or Chief Executive Officer or Managing Director between the CRA and the non-rating entity

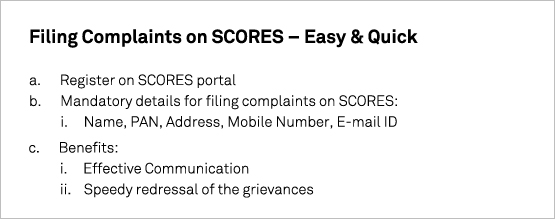

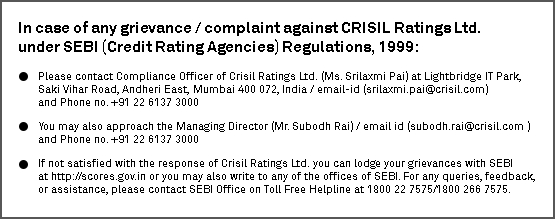

Disclosures as per SEBI Master Circular for Online Dispute Resolution

SEBI vide its master circular SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/145 dated August 11, 2023, has provided for an Online Dispute Resolution Mechanism for Clients of the Registered Intermediaries, to bring the provisions of this circular to the notice of the clients, and also to disseminate the same on their website. Accordingly, the Master Circular on Online Dispute Resolution can be accessed here

RBI

Compensation Arrangement

RBI's communication DBOD.BP.No./5385/21.06.007/

RBI's communication DBOD.BP.No./5385/21.06.007/

2012-13 - Compensation arrangements with entities seeking ratings on bank loans

Bank Statements

RBI’s communication dated August 30, 2018, reference no. DBR.BP.No. 1775/21.06.007/2018-19 on Bank Statements

Disclosure of Lender Details